We carry them around everywhere we go, and many of us feel naked without it, but our mobile phones are playing an ever increasing role in our lives, even going so far as to replace our wallet or purse.

There’s an idea called “cashless society” that has been floating around for years, presenting a future where money is still around, but less of us are using it in its paper, plastic, and metal forms. For years, people thought it would be credit and debit cards that would signal the end of coins and notes, but new research is suggesting that the mobile phone is changing the way we work.

Released by Nielsen this week, a study has shown that more Australians are using cashless payments, with 32 percent of the group studied switching to their mobile phone for paying for things, up from 12 percent 18 months ago. According to the research, more guys are using mobile devices to buy meals when they’re out and about, at restaurants and coffee shops.

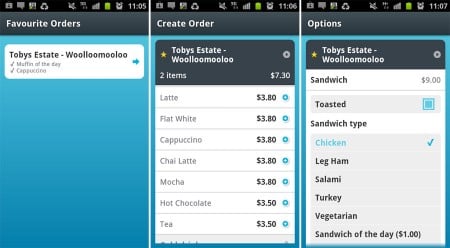

Here in Australia, we’re still waiting on Google Wallet to get its act together and let us pay for things with NFC on our compatible mobiles, but right now, downloadable apps like the Australian cafe servicing “Beat The Q” are helping out.

“I believe the move to a cashless society is imminent,” said Adam Theobald, founder of Beat The Q, a service he created after waiting in line for what seemed like forever in a queue at a Jack Johnson concert.

“A friend and I were waiting in the food line for 45 minutes, and when we eventually reached the counter, three young girls pushed in front of us. Disgruntled, we bargained with them, letting them go behind us instead. They agreed and moved back one space. I then proceeded to order 25 chicken burgers for all those in the line behind me and the group of girls. You should have seen the look on the operator’s face! They loved it. I then sold them to each person in the line for a couple dollars extra – they sold out in a matter of minutes.

“It was then that I realised time is precious, and there is a big market for convenience,” Theobald said.

For Beat The Q, that convenience is translated in the form of being able to order coffee, drinks, or food at various shops and cafes around the country, with a pick-up happening five or ten minutes later.

But evidence of the cashless society is happening more and more regardless, from our wallets even to our credit cards.

While the Nielsen research this week suggests payments are changing with mobile devices, it’s also having an effect on the wallet, as the fashion accessory adapts to match the constantly mobile nature of our lives.

Numerous Kickstarter projects are being started, each with a different look at how the redesigned thinner wallet should look.

Why carry around lots of notes and coins if you don’t need to?

The new wallet is more about keeping the necessary cards next to your phone, highlighting the desire to keep less bulk on our bodies and letting our phone do much of the heavy lifting, albeit virtually.

Credit cards are also changing with the cashless society, even though plastic was already as close to the “cashless” concept as it could get.

We’re finally seeing the LCD-equipped credit cards from MasterCard roll out around the world, affording consumers to ability to type in their PIN on the card itself, instead of on a terminal at a shop front.

Adding to this, we’re seeing collaborations that try to push the credit card inside the mobile phone, such as the MasterCard and Hoyts “QkR” concept which allows you to purchase food and drinks without leaving your seat at a cinema by use of either Near-Field Communication or QR codes.

Commonwealth Bank is trying its own form of mobile phone credit card system with the iCarte NFC iPhone cover, a case for the Apple iPhone 4 and 4S that brings Near-Field Communication technology to the Apple smartphone when partnered with the Kaching app from CommBank.

With all of these developments happening, you’d half expect that the cashless society is here already, with many people taking advantage of technology and using it to cut the weight of their wallet in half.

But really, the movement has only begun, and in the next few years, as more applications are developed and better smartphones come out, it’s likely that we’ll even be able to do away with the credit card, and turn to our mobile for our financial needs.

Beat the Q is brilliant